Already Have Mike’s New Book?

Get Chapters 3 & 4, and Bonus Research Here.

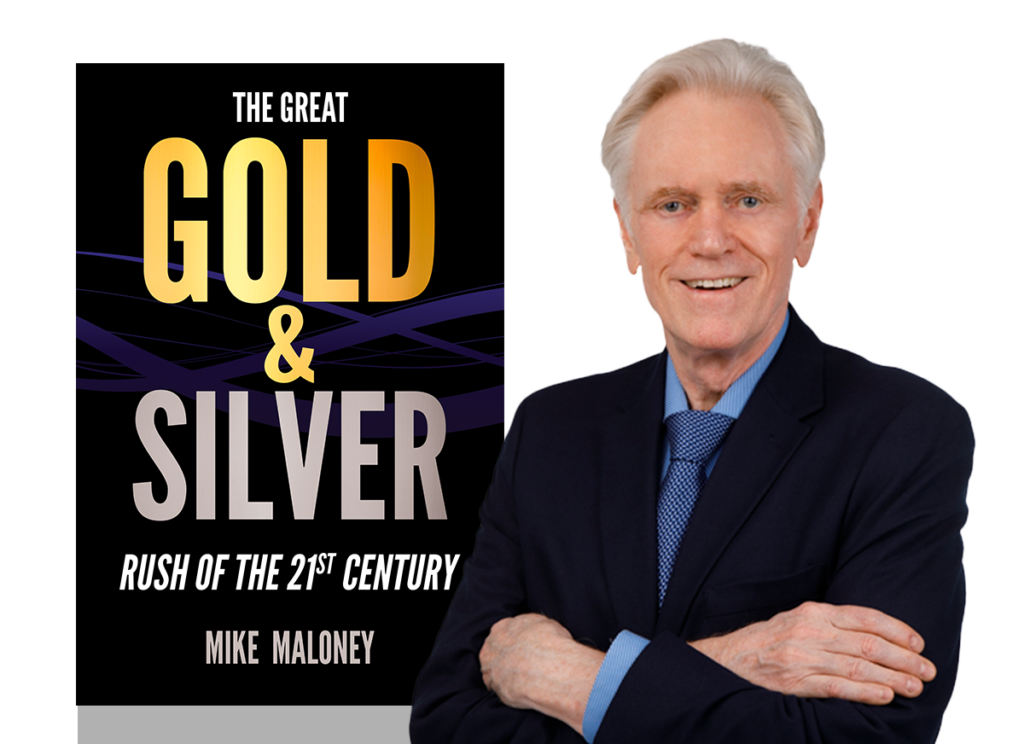

#1 Best-Selling Author Mike Maloney is BACK with…

Your Definitive Guide to the Greatest Wealth-Building Opportunity of This Generation

Since 2008, the evidence is mounting that the fiat currency system is on the verge of collapse. People can feel it. They are working harder for less. But the Federal Reserve doesn’t want you to believe it’s happening. Yet, a currency crisis is a mathematical inevitability. And there will be a brief, extraordinary moment in the near future where you can tremendously INCREASE your purchasing power, assuming you’re correctly positioned today.

The World’s Last Undervalued Assets

For years, bullion banks have used loopholes in reporting to artificially suppress the price of gold and silver. While stocks, real estate, crypto, bonds, and nearly every major asset class has attracted trillions in new investments, gold and silver have been largely ignored.

But as you’ll learn in Mike Maloney’s new book, a shift in investor behavior is underway. People are realizing they need a true store of value. It started in 2008, and it’s gathering momentum today. Soon, all this stored up energy will be released, propelling gold and silver to new heights.

Mike’s first book was published mere months before the 2008 Global Financial Crisis, where he warned of an impending meltdown that would send stocks and real estate crashing and gold and silver soaring. Of course, Mike was right and the thousands who listened to him profited.

But that crisis was only papered over. You were made to feel like it went away. You may even feel better off today than you did then. But underneath, the problem has been getting worse and worse.

You’ve likely seen the signs… high inflation, massive stock market swings, new speculative bubbles ballooning and popping. Something is wrong. And it all has to do with what happened in the years after 2008. We never paid the price for that crisis.

But as The Great Gold & Silver Rush of the 21st Century shows, we soon will. And Mike believes there’s only one guaranteed way to make it through.

Where Mike’s first book showed a crisis was possible, Mike’s new book explains why it is now inevitable. Set in the present, it provides overwhelming evidence that we are past the point of no return, facing a cataclysmic financial crisis that will affect every person on Earth.

As you turn the pages, you’ll see the enormity of what’s coming and understand that there is no avoiding it.

Plus, you’ll learn WHY assets like gold and silver are the best possible way to preserve your purchasing power in the years ahead..

In The Great Gold & Silver Rush of the 21st Century, you’ll learn how:

Our current financial situation could create the biggest bull market yet…

When inflation raged in the 1970s, gold went up 25.1X and silver went up 41.5X. But because the global currency supply is 55X bigger today than it was then – and everyone with a smartphone has access to the markets – Mike shows how this time around the bull market in gold and silver could be much bigger…

Exactly how central banks rob the middle class…

The world’s central banks are the biggest buyers of assets on earth… and they do it by counterfeiting. They simply type new currency into existence and buy whatever they like. But by increasing, and thereby diluting, the global currency supply, the central banks steal wealth from the poor and middle class and give it to the wealthiest people on earth. Mike shows you how to transfer it back…

The future of financial manipulation…

A sinister new type of currency could lead to an authoritarian nightmare. If the government wants the economy to be stimulated, they can charge you interest on your bank account, making you spend your money faster. If they want to arrest you, they can ban you from traveling and watch you by seeing where you spend each dollar. If they want to tax you, they can do it at any rate they like… and this oppressive system is already being tested in China…

The simple math that shows federal debt is no longer growing the economy…

For every $1 of federal debt we took on in the 1950s, we would get $6 – $8 of economic growth. Since 2008 we’ve averaged around $.50 and it’s been trending downward fast. In the years after 2008, we passed the point of no return and the truth is a monetary collapse is now inevitable. But the good news is that there are steps you can take to secure and maximize your wealth in the coming years, if you position yourself correctly today…

You’ll learn exactly how banks have suppressed the price of gold and silver…

New laws put in place from the US Comptroller of the Currency (OCC) have shined a light on the price suppression tactics of the bullion banks. History shows that free market demand has always overwhelmed manipulations. Luckily you still have the chance today to load up while these prices are artificially suppressed…

Why demand for silver will skyrocket in the years ahead…

According to a 2021 USGS report, minable silver deposits could be depleted in just 20 years. And that’s a nightmare scenario for the manufacturing industry. Because silver isn’t just a store of value. It’s the most electrically conductive metal on Earth. Our automotive, defense, aircraft, and aerospace sectors deeply depend on silver… and you can be certain that when supplies run short, government contractors will get what they need, at whatever price they have to pay…

How pandemic stimulus checks actually sent money to the 1%, while leaving the rest of us with inflation…

Many people think the pandemic stimulus checks were a big win for the middle class. Years later, we know those folks only got a tiny sliver of the new currency that was created. Mike shows how ‘free money’ policies inevitably cause inflation, hurting the middle class, while ultimately benefiting the 1% on Wall Street…

How the “invisible crash” crushed the middle class before anyone could notice…

For nearly two decades, the stock market traded sideways… But investors were horrified to discover that an unseen force destroyed the value of their investments, secretly tanking their value over 70%. It’s such a peculiar case that it took economists decades to realize what happened…

Mike’s thoughts on how new gold buyers should get started…

Mike shows readers how he helped pioneer the online gold-buying industry. Now you can buy as little as 1 oz increments of silver, or 1/100 oz increments of gold delivered to you, or stored in high security vaults like Brinks, where your gold and silver is fully insured and verified by independent auditors regularly. Not only that, it can be bought or sold instantly, or you can take delivery at any time…

Get your copy today

Proudly Sponsored by

Your Trusted Precious Metals Dealer